Expectations that Australia's 2022 sorghum harvest will end up north of 2.5 million tonnes is likely to cap prices in the coming months.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

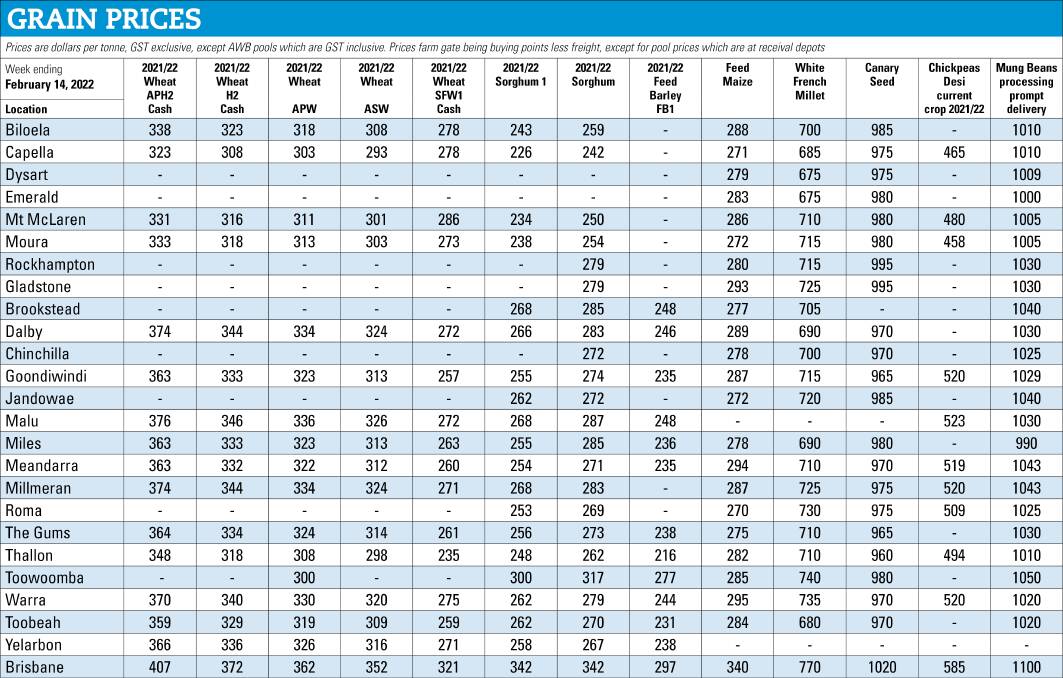

Sorghum prices are holding in the mid $290s delivered into the Darling Downs, as improved harvesting weather allows more of the crops to be cut.

Brisbane port values have been steady around $310 a tonne.

Domestic feed grain buyers are showing little interest in utilising sorghum at current prices, which are only at a modest discount to stockfeed wheat into the southern Queensland feedlots, pig, and poultry markets.

Most feed grain users are intent on maximising the volume of stockfeed wheat in rations where supplies are abundant following the wet winter crop harvest in NSW.

Feedlots are also soaking up as much barley as they can at the current $10-$12 discount to stockfeed wheat delivered into the Downs.

An Australian sorghum crop of more than 2.5 million tonnes would be the largest in 14 years and require a massive export program to move the harvest. A crop of this size is not assured, as it would require a large Central Queensland sorghum harvest, where many farmers are still planting.

China has been the major destination for Australian sorghum exports, and this is expected to continue in the next 12 months. Australia exported about 1.65 million tonnes of sorghum in the 2021 calendar year, with more than 80 per cent shipped to China.

Japan is also a regular buyer of Australian sorghum, and this is expected to continue in 2022. Kenya was also a sizable buyer of Australian sorghum in the 2021 season.

Stockfeed wheat prices remain well supported, in a mix of unrelenting exporter appetite and domestic market short covering.

US wheat futures rallied last week as values recovered from the prior sell-off, as fears of conflict in the Black Sea escalates with the build-up of Russian troops along Ukraine's border. It's a volatile mix for global wheat markets, as global cash markets have been drifting lower in recent weeks on lagging export sales.

The South American drought is also offering support for global feed grain and oilseed markets. Drought and scorching temperatures have slashed the South American soybean production forecast by upwards of 25 million tonnes in the past two months.

Corn crops are now in the firing line, with crops now vulnerable to adverse weather as they enter critical development phases.

- Details: 0428 116 438 or lloyd@agscientia.com.au