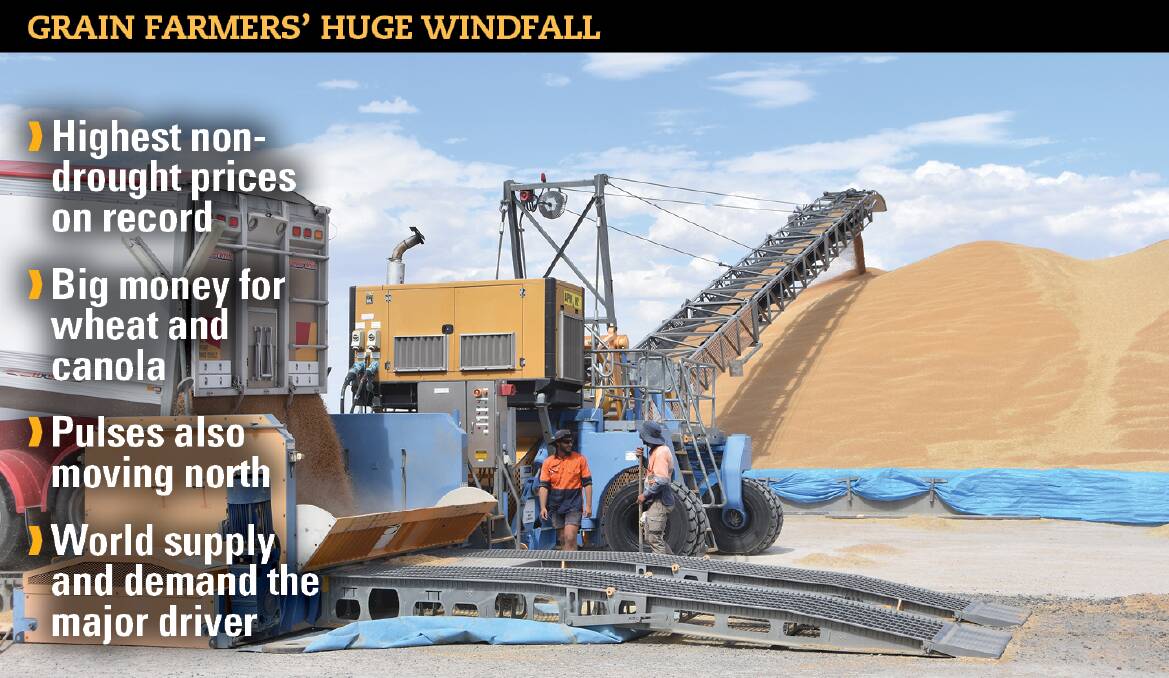

A FAVOURABLE supply and demand equation has seen grain prices hit records at an international level throughout much of 2021.

Fortunately for many Australian farmers, unlike many years of high grain prices, they have enjoyed average or better crops meaning they are able to cash in on the boom.

Long-time grains industry analyst Malcolm Bartholomaeus, Bartholomaeus Consulting, said while there had occasionally been prices challenging current levels it had not happened in years of good production.

"We have seen regional drought premiums kick prices to high levels but this is the best year overall," Mr Bartholomaeus said.

"In South Australia we have the highest ever prices for both wheat and canola and it is even getting close to records in NSW, where we had those really high prices during the 2018-19 drought when there was very little grain about," he said.

Mr Bartholomaeus said it was also a boon that farmers were able to readily access the prices off the header.

"There have been other instances where prices have been good during the year and people have had a chance to lock some in but you rarely see prices at these levels just for those tipping off at the local site at harvest," he said.

"This is easily the highest price we've seen off the header."

Prices for APW quality wheat in the Port Adelaide port zone hit $435/t earlier this month, which Mr Bartholomaeus said beat previous drought-impacted times of high prices.

"We've averaged $407 for the early part of December, compared to a previous high of $390/t," he said.

Ron Storey, Storey Marketing Services, said it was a price record or close to.

"There are strong values, and it is nearly across the board, we've got wheat, canola and pulses all at or close to their record price," Mr Storey said.

RELATED: Grain prices trend higher

RELATED: Grain prices smash records

He said the market was red-hot globally because of supply and demand issues.

"Grain prices are at record levels here in Australia but on the global scale we are one of the cheapest sources of grain, so there will be no problems selling," he said.

"The basis is incredibly low," Mr Storey said.

The comparisons are even more impressive in canola.

"The highest SA prices off the header was $660/t, we've seen plenty of days with cash prices of $930-950/t," Mr Bartholomaeus said.

"Even though the wheat price has ramped up, canola has maintained that traditional spread of double the price of wheat."

In comparison barley is the laggard this season.

"$300/t is far from a bad price historically but when you see Barley 1 feed barley at $130-150/t under ASW and APW it is a big discount," Mr Bartholomaeus said.

"Even the premium for malt is only around $20/t, so it is still a long way short of the numbers for milling wheat."

"APW wheat is not overpriced compared to the world market, which means barley has to be regarded as cheap."

Mr Storey agreed.

"In a flat price sense it is still good, but there is a huge discount to wheat," Mr Storey said.

Looking forward, Mr Bartholomaeus said in spite of the record prices there was not a lot of negative pressure in the near term.

"The market will be closely monitoring what happens with the northern hemisphere crops as we get further into 2022, but until then things are largely in a holding pattern," he said.

However, he cautioned farmers holding out for higher prices to consider where the market was.

"We're at record levels, while some have convinced themselves it will go up further you have to think of whether there is more upside or downside risk at current prices," he said.

Mr Storey said other croppers across the globe would see the prices on offer and would also try to cash in.

"That's the thing with grain, it takes around 100 days to grow a crop in the northern hemisphere so things can change quite quickly, but we've probably got until April before we start getting more of a handle on the northern hemisphere crop and in that time Australian exporters will be busy loading boats."

Start the day with all the big news in agriculture! Sign up below to receive our daily Farmonline newsletter.