IN Australia, it is hard to get a handle on fertiliser pricing data, so we decided to do the next best thing, a model to work out what roughly fertiliser pricing should be in Australia.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

As far as we are aware, Thomas Elder Markets (TEM) was the first to publish publicly the CFR+ model, and over time we hope it helps farmers and the broader industry get better insights into pricing levels for one of their most important inputs.

The CFR+ model sounds more complex than it is.

It is basically a simple addition of factors* that drive the price:

- The cost of purchase at origin - loaded onto the boat.

- The freight cost to destination (Australia).

- The cost of discharging

Fertiliser prices have increased dramatically in recent months and continue to be hampered by high energy prices and the subsequent political moves (quotas/bans).

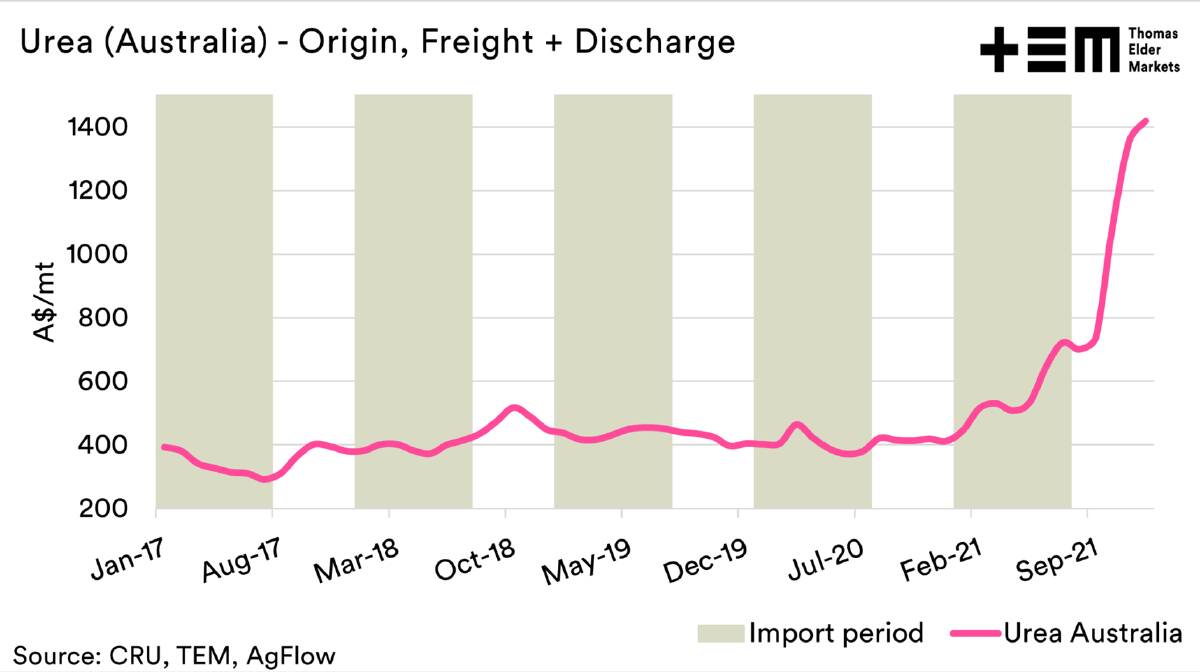

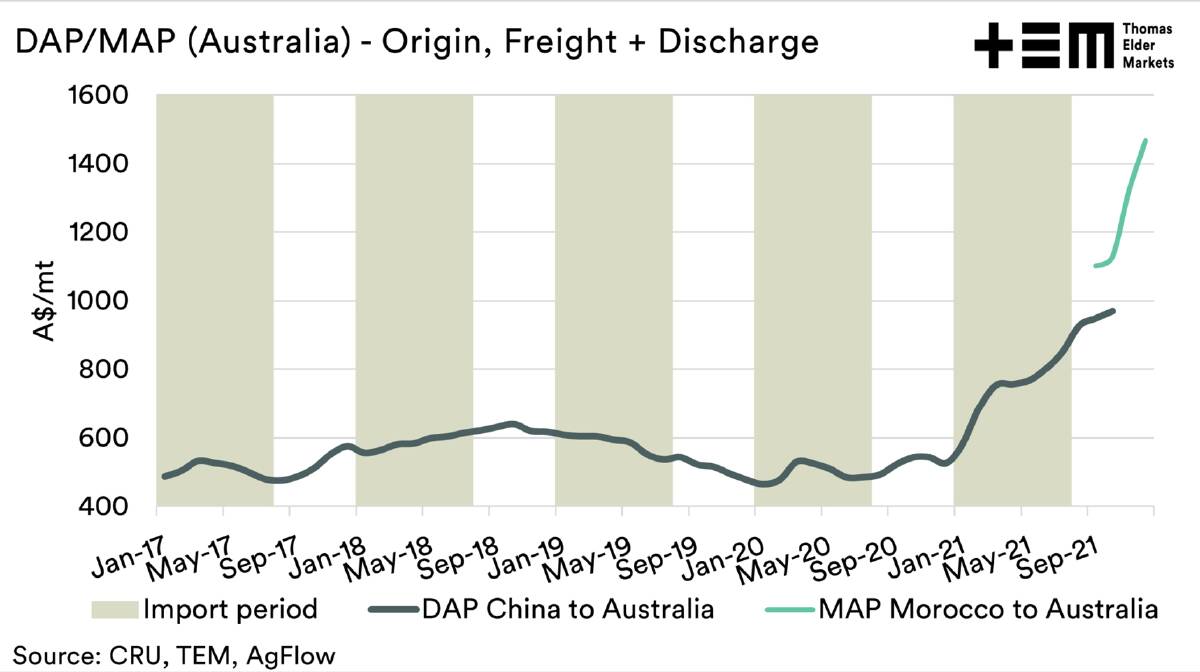

The charts show the CFR+ model for Urea and DAP/MAP into Australia.

The urea price has increased by 92 per cent since September when the fertiliser market started coming under real strain, although most worrying is that the price is up 230pc since last November.

The modelled price for December is currently in the range of A$1400-1430.

As we all know, China has banned exports of fertiliser, which has a massive impact on our DAP/MAP imports.

Typically we would use China as an import origin.

As Chinese exports are unavailable, we have switched to Morocco although there are rumours of Mexican cargoes loading in December.

Since September, DAP/MAP is up 55pc and 170pc since last November.

The current modelled value is currently in a range of A$1450-1475.

It was a surprise to me to see the values of the CFR+ model, as I was hoping for a bit of stability.

As farmers, we are going to have to ensure that we do some good calculations over the coming months.

If you want to be kept abreast of what is happening in the agriculture markets, make sure to sign up for the free TEM email update - just go to thomaseldermarkets.com.au/sign-up/

You will get notified when there are new analysis pieces available and you won't be bothered for any other reason, we promise.

If you like our offering please remember to share it with your network too - the more the merrier.

*It is important to note that this price does not include margins, administration or internal Australian logistics costs.

It does provide a good overview of the trend, and roughly where the price should sit before these additional costs are added.

Want weekly news highlights delivered to your inbox? Sign up to the Farm Weekly newsletter.