Sheep skins are in the middle of a price resurgence as offshore demand lifts, spurred along by higher wool prices and tight supply of sheep and lamb.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

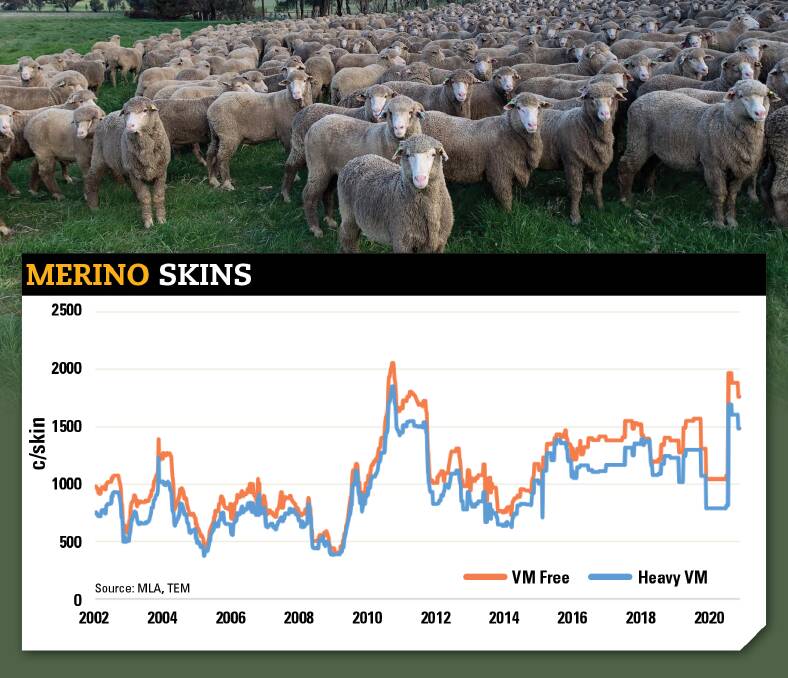

In particular, Merino skins free of vegetable matter are heading towards record highs, rallying 88 per cent from 1043 cents per skin at the start of 2021 to prices close to 2000c/skin.

With prices now drifting towards the $20 mark, and anecdotal reports of closer to $25 returns, it's a stark contrast from 2020 where prices for sheep skin fell dramatically and industry specialists forecast no real recovery in the short-term.

Another victim of the COVID pandemic, prices fell below $10 a skin.

With sheep skin mostly used for fashion apparel such as slippers, gloves and hats, and with the global economic downturn, there was less wealth out there to purchase those type of items.

Thomas Elder Markets analyst Matt Dalgleish China is the dominant export market for Australian sheepskins, soaking up over 90pc of the flows during the past five years.

"There is also anecdotal reports of an increase in Chinese buying activity in 2021 that is beyond the recent price surge," Mr Dalgleish said.

"In 2020 China accounted for 93.8pc of the Australian sheep skin export trade, followed by Turkey on 1.1pc and Russia in third place on .8pc."

Data collected also shows over the last five years China has averaged 92.3pc of the Australian export trade of sheepskins, meanwhile Russia and Turkey have averaged 3pc and 1.2pc respectively.

Thomas Foods International (TFI) skins and hides manager Simon Matters said the skins market tends to follows the path of the wool market.

"If the wool market is consistently strong, the skins market will be consistently strong," Mr matters said.

"As soon as there are any dips in the wool market, the Chinese will panic and the skin market may well come back quicker than the wool market."

He said when skins get to China the wool is removed often clipped back to a length used for shoe and coat linings.

Shorter length skins, he said, don't tend to rely on the wool market at all with prices more to do with the end use of them, which is mainly lining.

And although the shorter length lamb skins (1 to 2-inch) aren't making any great headway in the market, they are currently doubling what they were returning on April 2020.

"A 1 to 2-inch shorn lamb would have been making about $3 for the farmer," Mr Matters said.

"But now they are returning about $5 or $6 for the farmer.

"Obviously the more wool length, the better the price.

"Two-inch and up make the most money and once you get under an inch it is not so dependent on wool, it's more dependent on the end use."

Mr Dalgleish said Merino skins with heavy VM also recorded price increases lifting 115pc during the first half of the season from an average price of 785c/skin to hit 1690c/skin.

"Analysis of the spread between Merino skins that are VM free compared to skins with heavy VM highlights that over the long-term, VM free skins achieve an average premium of 18pc to skins with heavy VM," he said.

"While it is not uncommon to see the VM free premium fluctuate between 10 and 25pc, movements in the premium beyond 32pc or towards a discount are fairly rare."

Currently the premium spread of VM free Merino skins to heavy VM skins sits marginally above the long-term average at around a 19pc premium.

Start the day with all the big news in agriculture! Sign up below to receive our daily Farmonline newsletter.