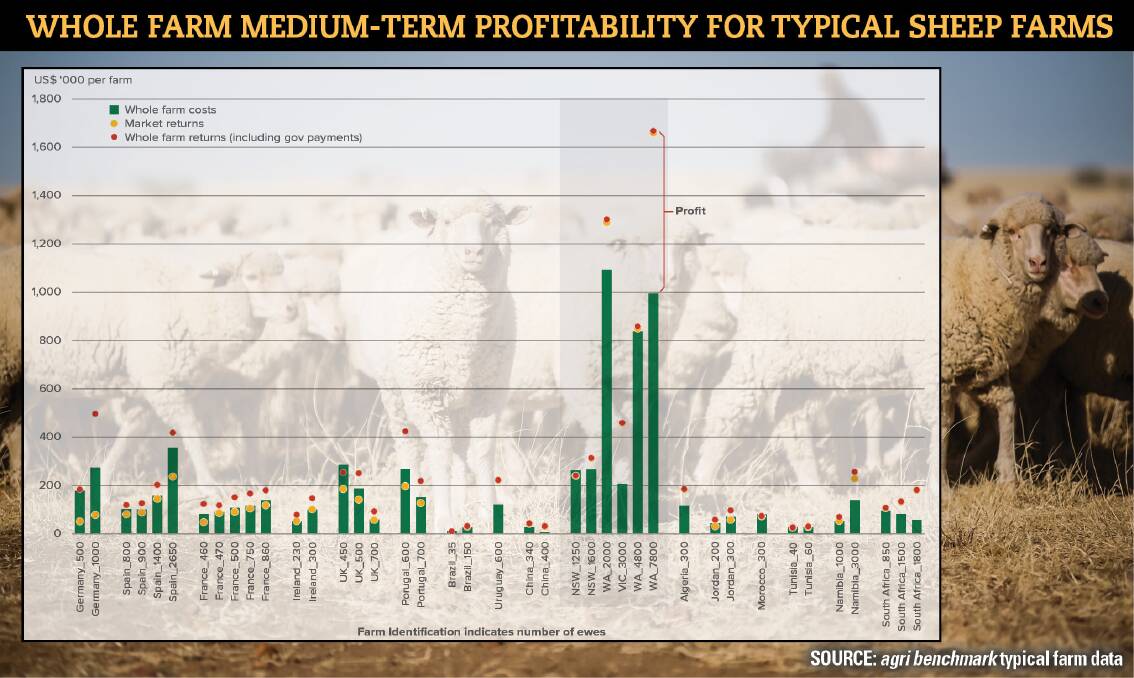

Compared to international contenders, Australia's mixed sheep farms are the leaders when it comes to the world's most profitable farming enterprises.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

And Western Australian mixed sheep-cropping enterprises are the most successful in the world.

This is according to the annual agri benchmark report released by Meat and Livestock Australia which said due to strong demand, constrained supply and high prices, Australian sheep farms hold a strong position on the global whole-farm front.

The report, How are global and Australian sheep producers performing, compares costs, productivity and profitability of Australian sheep farms against 16 other countries.

It also found that Australia has some of the lowest cost sheep meat producers in the world all performing below the global average cost of production which is US$482 per 100kg live weight production.

And Australian ewes rated the highest in the world, with close to 100kg of live weight produced per ewe over their lifetime.

"The high productivity of Australian ewes is what drives the profitability of Australian farms," MLA's market information manager Stephen Bignell said.

"On the other hand, weaning rates among the Australian flock was generally lower than the global average.

"It is interesting that we can be the most profitable, yet our weaning rates are very low. In some countries like the UK and Ireland, weaning rates of 160 per cent are being achieved."

Mr Bignell said Australia's result was impressive considering the benchmarking activity was held in the midst of a sever drought in NSW and below average conditions in Victoria and WA.

"Five of the six typical Australian sheep farms were profitable in 2019, though most were impacted by poor seasons," Mr Bignell said.

"Out of the six Australian farms, the three that were most profitable were in WA, while the two NSW farms in severe drought had low profits or modest losses.

"Profits deteriorated on four of Australia's six sheep farms in 2019 with the drought lowering lamb output and raising feed costs.

"Boosting those cash receipts in those WA mixed sheep-cropping enterprises was the grain portion."

The report highlighted that the WA farms were around sheep-cropping splits of 50-50, underpinning mixed cropping sheep farms are a super profitable enterprise.

"When compared across other countries, they don't have that cash-crop component like the WA farms," Mr Bignell said.

The report highlighted was there was no government subsidies in Australia.

Yet across the world, in particular on European farms, at least 30 per cent of cash flow came from government subsidies.

Overall, sheep farm enterprises remained high across the globe due to high lamb and sheep prices and increased sheepmeat demand, particularly from China, coupled with constrained supply in Australia, NZ, EU and China.

Mr Bignell said in the past decade, international sheepmeat production has grown significantly in China, Central Asia and North Africa - most notably in Algeria, Uzbekistan, Chad, Sudan and Turkey.

And from a demand perspective, in the 10 years to 2019, global demand for sheepmeat grew by 2.2 million tonnes carcase weight (cwt).

But he said the report underlined, as with Australian cattle farms, high land prices are putting pressure on sheep farms' long-term profitability.

"Most Australian farms are short-term and medium-term profits - that's cash receipts minus cash costs and depreciations," he said.

"Long-term profitability includes opportunity costs.

"Although in Australia more than half of the farms will be profitable in the long-term, that long-term profitability does highlight the consideration around paying attention to land values."

Australian sheep farms generally pay less for stock feed compared to global competitors, however, this can be attributed to the fact that half of Australian sheep farms are mixed cropping enterprises that don't need to buy feed and can feed sheep on crop stubbles.

"Australian sheep farms also have higher machinery input costs compared to global competitors," Mr Bignell said.

"But this is easily explained by the high percentage of mixed sheep and cropping farms in Australia that require costly seeding and harvesting equipment.

"Against the other countries we are paying over in vet medicine, insurance and taxes, sit around the ballpark figure in feed, but in energy, water and fuel we are paying under the average figure."