AUSTRALIAN farmers are remarkably well-placed to turn healthy profits in 2021, despite the fact the economy is crawling out of economic crisis and our largest trading partner is dealing out punitive action.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

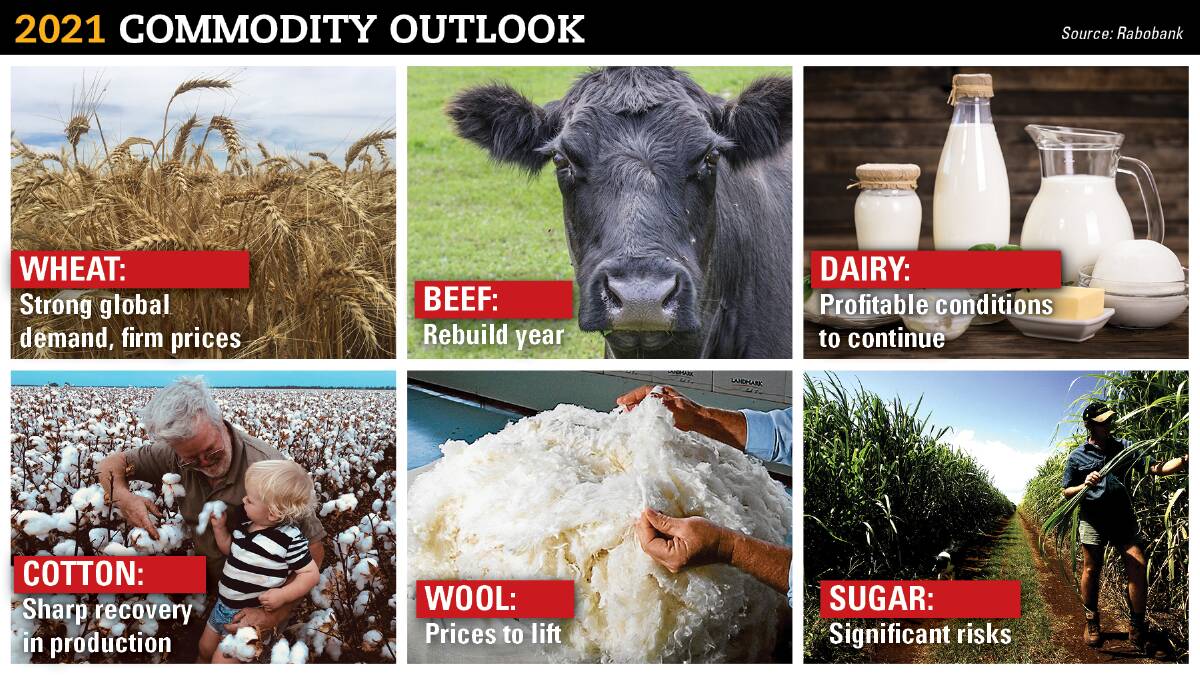

Key industry projections released today point to ongoing strong global demand for food underpinning high commodity prices, which will combine with Mother Nature's generosity to deliver solid margins to the farmgate.

In its flagship annual Agribusiness Outlook for 2021, global agribusiness banking specialist Rabobank says a generally profitable current financial year for most Australian farmers will kick start recovery from the severe drought.

Report lead author, Rabobank head of Food & Agribusiness Research Tim Hunt said the level of demand for food had not been surprising through the pandemic but the ability of people to pay was.

Unprecedented levels of government support for consumers around the globe meant the worse crisis since World War II actually resulted, in many cases, with consumers' incomes improving, he said.

"That in turn underpinned sales of food and enabled agriculture to bypass the worst of the crisis," he said.

Of course, COVID-19 continues to rage and add to the turbulence in place across Australian agriculture's marketplace, which also includes political tensions and trade wars.

Rabobank reports market intervention is very much back in vogue, affecting the grains industry in particular.

Several major importing countries appear to be stockpiling to mitigate risk of shortages with grain exporting countries tossing up export quotas and taxes as they fret over food security, Mr Hunt said.

"Grain feeds through to bread and noodles, staple parts of diets in many areas, and governments are very wary of civil unrest as they deal with the pandemic," he explained.

"The sudden prospect of weaker production in the northern hemisphere has triggered strong buying programs in the likes of China and Morocco, while exporters like Russia are looking to keep sufficient grain on stock."

The ensuing demand is good for Australian farmers in the short-term, Mr Hunt agreed, but in coming months we'll see those stocks reach levels where buying will ease. The excess stocks have to be consumed at some point in time.

Meanwhile, the strongest Australian dollar since 2014 is certainly a headwind, taking the shine off global pricing.

"We must realise the same factors driving up the Aussie dollar have driven up commodity prices," Mr Hunt said.

"What we are seeing here is the automatic stabiliser at play and it is playing a role in a general improvement in the world economy."

Favourable weather

The Rabo Outlook makes the point La Nina has played into Australian farming's hands, while at the same time crimping the production prospects of competitors offshore.

Large parts of the US, Latin America and eastern Europe are unusually dry and that has helped to significantly tighten international markets and drive up global commodity prices, it says.

Back home, above-average rainfall has set up higher-than-usual soil moisture to open 2021 and boosted storages across the Murray-Darling basin, improving board acre farm incomes, improving locally-grown feed and underpinning better water allocations for irrigators.

On the beef and sheepmeat front, global animal protein stocks will ramp up this year for the first time in three years, Mr Hunt said.

"We have some catch-up to do, however. After two years of declining production it will take more than one year to recover to the production levels we saw pre-crisis, so the market will remain tight," he said.

The ripper local season and the restocker fervour it created proved the stronger driver of cattle prices all last year and that is expected to continue.

"It's worth reflecting upon livestock prices in New Zealand that are currently at or below the five-year average," Mr Hunt said.

"NZ farmers are selling into the same export markets but they don't have restocking squeeze going on at home."

Mr Hunt did say, however, that processing and feedlot sectors in Australia would have to carefully manage the divergent trends of tight markets for young livestock and softening global prices for meat.

Rabobank also outlines the major transitions it sees as being ahead for agriculture in the report.

They are reducing the sector's reliance on the Chinese market, recovery from the effects of the COVID-19 and adjusting to a market more focused on sustainability.

ALSO SEE: