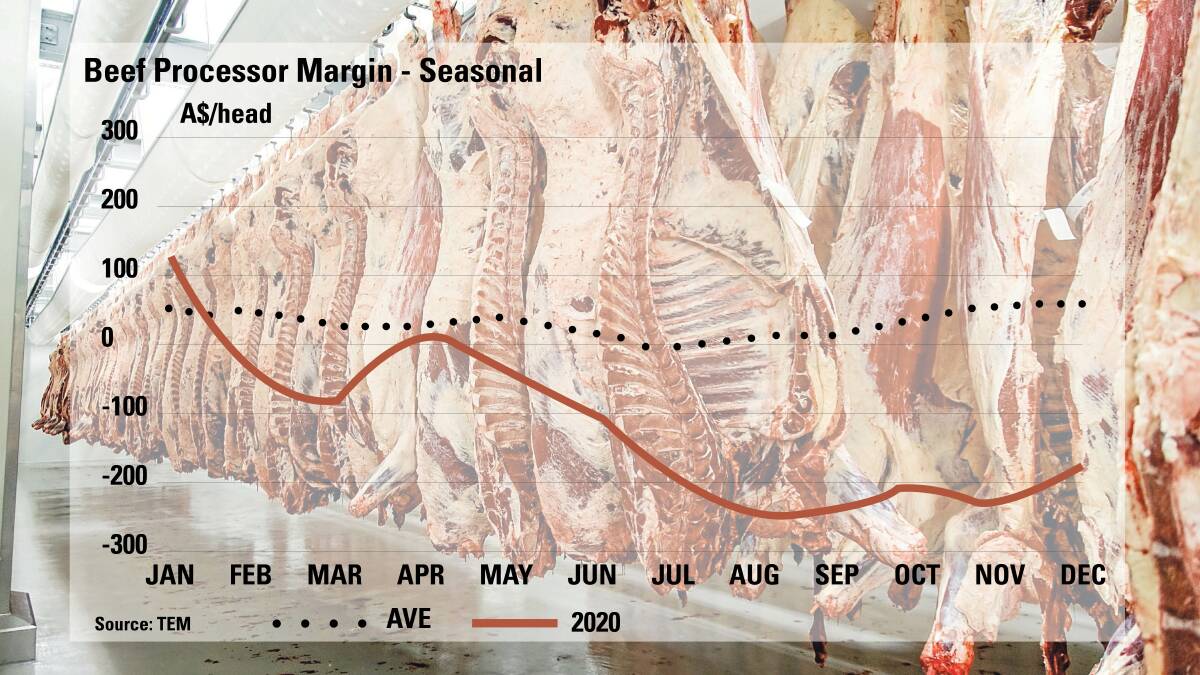

THE NEXT six months will purely be about survival for the nation's beef processors as the massive losses now being incurred look like tipping into a record negative profit margin of $300-plus a beast slaughtered.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

The rest of the supply chain, particularly producers, along with regional towns the nation over, are biting their nails waiting to see what the wash-up will be.

Historically, lengthy periods of negative processor margins have always resulted in some degree of rationalisation. Already, many plants are operating reduced shifts but the hope is a wave of permanent closures is avoided.

Processors are facing severe shortages in two major inputs - livestock and labour.

What they are paying for cattle, where they can even secure enough for a kill, is grossly out of sync with their international competitors.

How long that situation can suffice is something analysts pondered much of last year.

Since cattle markets opened this year, ongoing rain has exacerbated the struggle to source enough cattle to kill and both saleyard prices and grid rates have skyrocketed to never-before-seen levels.

Analysts are now anticipating a corresponding never-before-seen negative margin for processors when they run the next set of modelling at the end of January.

Thomas Elders Markets' Matt Dalgleish said processor margin figures slightly improved for December due to the cattle market dip as producers offloaded in a short month before Christmas.

However, leading up to December the losses were pushing the $300 mark for some time, he said

At the start of last year, processors were in positive territory, only marginally, but by February they'd hit the red. April saw a small positive blip but it has been one-way traffic since then.

TEM's theoretical beef processor margin model has the annual average at a loss of $129 for the 2020 season.

Mr Dalgleish said that mirrored the losses during 2016 and 2017.

Whether the enormous profits processors made during drought-induced cattle sell-offs in 2014-16, then again to a lesser extent in 18-19, is enough to provide the buffer now required to ride out the current headwinds is the great unknown.

The length and depth of this downturn is relatively severe, long-time industry observers say.

While processors by nature play a long-term game, there is no question they need extremely deep pockets right now.

Patrick Hutchinson, who heads up the processor peak body the Australian Meat Industry Council, said unique to today's situation was that processors had been hit with so much in the one go.

There is the uncertainty of a global pandemic and the logistical challenges it is throwing up, lack of labour, trade issues particularly with key market China, the high Australian dollar and very tight livestock supply and the corresponding high prices.

"On a per-head basis, in both cattle and sheep, processors are in heavy negative territory," Mr Hutchinson said.

Another interesting element to the 2021 situation is that where in the past producers have not been too upset by processor losses, given the money they make in dry times, this time there is real concern about long-term buying competition for their stock and the economic losses to rural towns that flow from processor pain.

Part of that has perhaps come from the fact livestock prices in certain categories stayed relatively strong during the last drought, powered largely by Chinese demand.

But there has also been a shifting sentiment towards a more 'entire supply chain outlook' and an improved camaraderie within the various beef sectors, Mr Hutchinson agreed.

That, in turn, had delivered a stronger voice to the industry in dealing with governments, he said.

To help the current situation processors were battling, lobbying work was currently being done on red tape reduction, pay roll tax relief, the ability to access labour and opening trade markets, he said.

"While some advances may be incremental, they also serve to send a message to processing companies about how our industry is valued which in turn builds confidence," Mr Hutchinson said.

"Meat processing will underpin Australian agriculture's goal to grow into a $100b sector by 2030.

"If meat processing sneezes, agriculture gets a cold.

"The short-term is about survival for processors. These are strong, long-term, often family-owned operations and they have a lot of understanding about cycles and a proven resilience. They foresaw big impacts and a lot of contingency planning and preparation has been put in.

"That, however, does mean hard decisions have to be made."

ALSO IN BEEF: