Darling Downs farmers have started harvesting what's expected to be one of the largest sorghum crops in several years.

Early yields have been strong with crops coming in at 5-6 tonnes a hectare and this pattern is expected to continue. Timely planting rains and above average summer rainfall has set the platform for above average yields.

Large plantings and good yields are expected to see Southern Queensland produce upwards of 1 million tonnes of sorghum for the season. Sorghum planting is under way in Central Queensland where most farmers are anxious for more rain to top up soil moisture levels.

Domestic buyers are showing limited interest in sorghum at current prices as they take advantage of the large feed wheat supplies after the wet winter crop harvest. This should see most of the Queensland sorghum crop move into export markets, as it did last year.

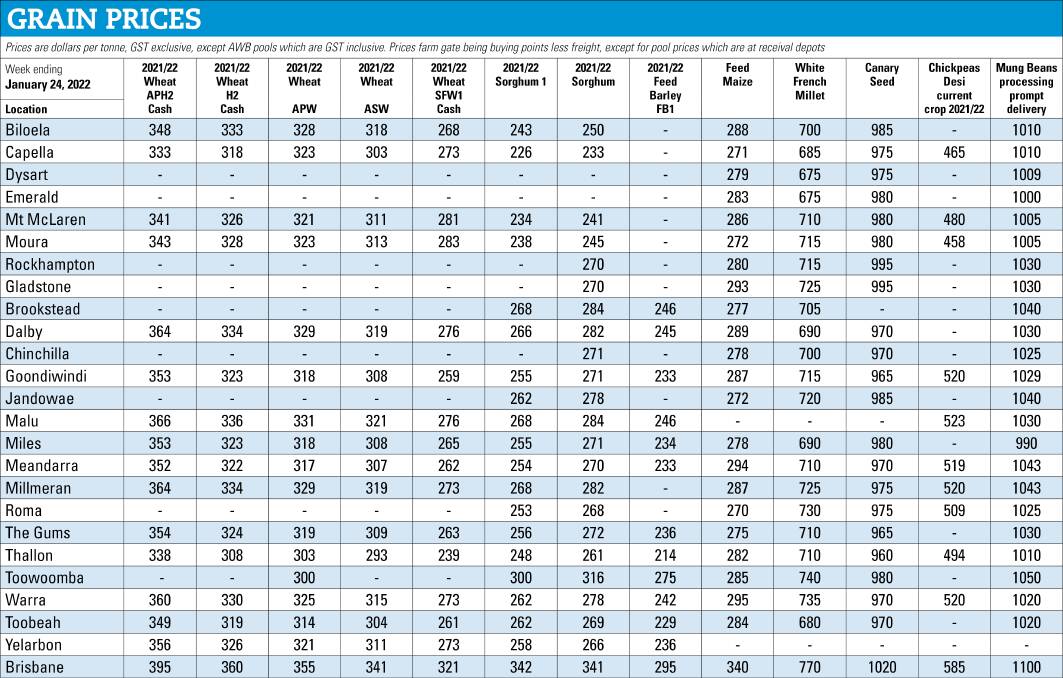

Stockfeed wheat bids are holding at $300 delivered into the Darling Downs destinations, which is on par with sorghum. Sorghum bids are holding around $300 a tonne delivered into depots.

Traders are reporting strong export demand for sorghum. China is expected to be the major destination following a large import program in the past 12 months.

It's expected that traders have also sold a significant volume of sorghum in bulk and containers into China.

China's appetite for feed grain imports remains strong, although total imports are expected to be down on the 2021 calendar year imports. China's corn imports almost tripled from the previous year in 2021 to a record large 28.3mt. China also imported large volumes of barley, sorghum and feed wheat.

A larger domestic corn crop put pressure on domestic corn prices in China late last year, but they have since recovered as drought conditions threaten production in South America.

China is also expected to absorb a significant proportion of the feed wheat exports from NSW this year. Torrential rain at harvest time is expected to have downgraded as much as three-quarters of the NSW wheat harvest to feed wheat quality. The state's wheat exports for the 2021/22 season, which will be close to 6mt, are expected to be dominated by low quality wheat.

Feed wheat prices are being well supported through NSW at around $285 on farm, as exports chase supplies.