2020 finished with a flourish. The end of year rally pushed Chicago Board of Trade wheat futures to contract highs, and to multi-year highs not seen since 2014.

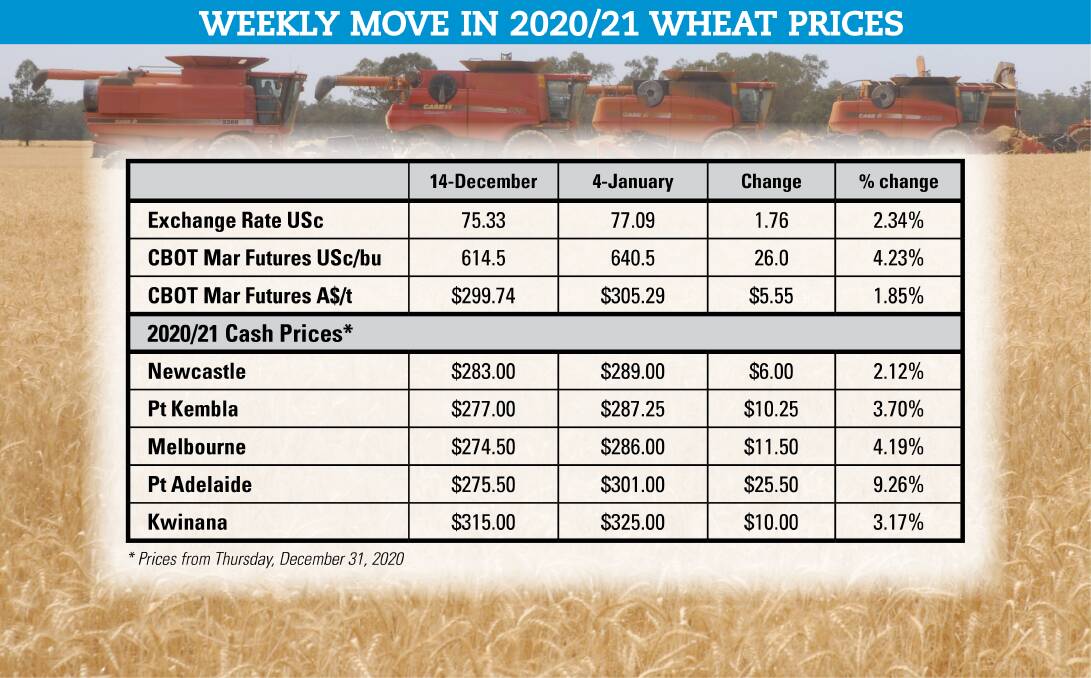

The Australian dollar also surged to be above 77 US cents at year's end. While that capped the prices in $A terms, it was enough to push the $A value of March CBOT futures back above $A305 a tonne, and to its best level since November 11.

Australia has also just produced a very big crop. It will take some time for the estimates to be finalised, and while some growers have missed out, there are multiple sites across SA, Victoria and NSW where all time record yields have been reported.

With the big crop has come high wheat prices for a non drought year. Export-based pricing shows that the average price from November 1 to December 15 is the equal highest since 2007, making it the second highest harvest prices on record in the absence of drought.

What has annoyed some growers is a lack of price premiums for higher quality wheat grades, and sharp price falls coinciding with harvest, denying some growers the opportunity to sell off the header at prices above $300/t port basis.

Hence a number of growers are lamenting the good old days of the singe desk (now 13 years ago). They want the premiums that system seemed to offer, and they want to get paid 80 per cent of their crop value at harvest, and they suspect anti-competitive behaviour is behind the harvest price decline.

Protein premiums are driven by supply and demand. We can artificially pay a premium (i.e. get APW and ASW growers to subsidise those with hard grades), or we can take what the market offers. Those complaining now did not complain when premiums for hard wheat were $100 above APW in the same free market a few years ago.

It is unrealistic to expect the market to absorb the full Australian crop over an eight-week period, and pay growers in full. Anyone still wanting that should make use of one of the pool products still on offer. The alternative is to have a marketing plan that will sell into a market when the prices they want are on offer, for example when the market was in the $300 to $330 range in October and November.

And what was a major driver of lower prices? Declining international prices and futures prices. At the same time that our market shed $52/t, CBOT futures fell by $A46.80/t. Hardly a home grown conspiracy there! And just maybe aggressive selling by Australian farmers played a part in that price fall.

- Details: 0411 430 609 or malcolm.bartholomaeus@gmail.com